Introduction

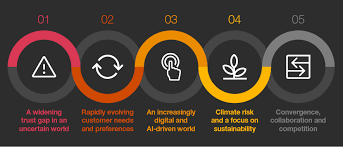

The insurance assiduity, like several others, is witnessing rapid-fire metamorphosis driven via technological advancements, transferring customer prospects, and arising pitfalls. As we look ahead, it’s essential to explore the trends and inventions shaping the future of insurance, from digitalization and data analytics to substantiated content and sustainable practices.

Digitalization and Automation

One of the maximum considerable traits shaping the future of insurance is digitalization and robotization. Insurers are the usage of technology to streamline procedures, decorate client enjoy, and ameliorate practical effectiveness. From on-line policy operation systems to AI- powered chatbots for customer assist, digital equipment are revolutionizing how insurance products are offered, vended, and serviced.

Data Analytics and Predictive Modeling

Data has continually been at the coronary heart of insurance, but improvements in statistics analytics and prophetic modeling are taking threat evaluation and underwriting to new heights. Insurers are employing big data, machine literacy, and artificial intelligence to dissect vast quantities of information, identify patterns, and prognosticate unborn issues with lesser delicacy. This allows insurers to knitter content, pricing, and threat operation strategies to individual policyholders grounded on their unique characteristics and actions.

Personalization and Customization

In an period of substantiated gests , consumers are decreasingly awaiting insurance products and services acclimatized to their specific requirements and preferences. Insurers are responding by offering more flexible content options, customizable programs, and substantiated pricing grounded on individual threat biographies. Whether it’s operation- grounded bus insurance, on- demand content for gig workers, or microinsurance for low- income homes, the future of insurance is each about meeting the different requirements of moment’s consumers.

Insurtech Disruption

The rise of insurtech startups is dismembering the traditional insurance geography, driving invention, and grueling established players to acclimatize or risk getting obsolete. Insurtech companies are using technology to produce new business models, develop innovative products, and ameliorate the effectiveness of insurance operations. From peer- to- peer insurance platforms and blockchain- grounded smart contracts to IoT- enabled bias for threat monitoring, insurtech is reshaping the way insurance is conceived, vended, and managed.

Cybersecurity and Risk Management

As cyber pitfalls continue to evolve in complexity and scale, cybersecurity is getting an decreasingly critical concern for insurers and policyholders likewise. The future of insurance will see a lesser emphasis on cyber threat operation, with insurers offering technical content for data breaches, cyberattacks, and other digital pitfalls. also, insurers will work nearly with cybersecurity experts to develop visionary strategies for mollifying cyber pitfalls and enhancing cyber adaptability across diligence.

Sustainable and ESG-focused Insurance

With growing mindfulness of environmental, social, and governance( ESG) issues, the insurance assiduity is embracing sustainability as a core principle of its business practices. Insurers are integrating ESG criteria into underwriting opinions, investing in green enterprise, and developing products that promote sustainability and adaptability in the face of climate change. From renewable energy insurance and green structure content to parametric insurance for natural disasters, sustainable insurance results will play a vital part in erecting a more flexible future.

Conclusion

The future of insurance is really instigative, with technology driving invention, personalization, and sustainability across the assiduity. As insurers acclimatize to changing consumer prospects, arising pitfalls, and nonsupervisory conditions, they must embrace digital metamorphosis, influence data analytics, and prioritize sustainability to thrive in the times to come. By staying ahead of trends and embracing invention, the insurance assiduity can continue to fulfill its essential part in guarding individualities, businesses, and communities against unlooked-for pitfalls and misgivings.