Introduction

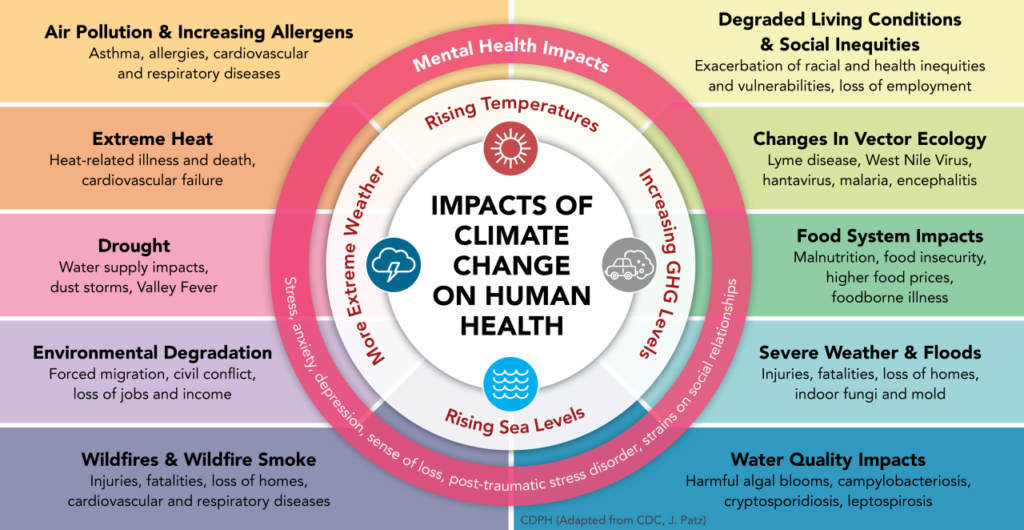

Climate change poses huge demanding situations to societies, husbandry, and diligence around the arena, which include the insurance zone. Rising global temperatures, extreme rainfall events, and shifting climate patterns are adding the frequency and inflexibility of natural disasters, leading to advanced insurance claims and losses. In this composition, we’ll explore the impact of climate trade at the coverage assiduity and bandy how insurers are conforming to relieve new pitfalls and demanding situations.

The Impact of Climate Change on Insurance

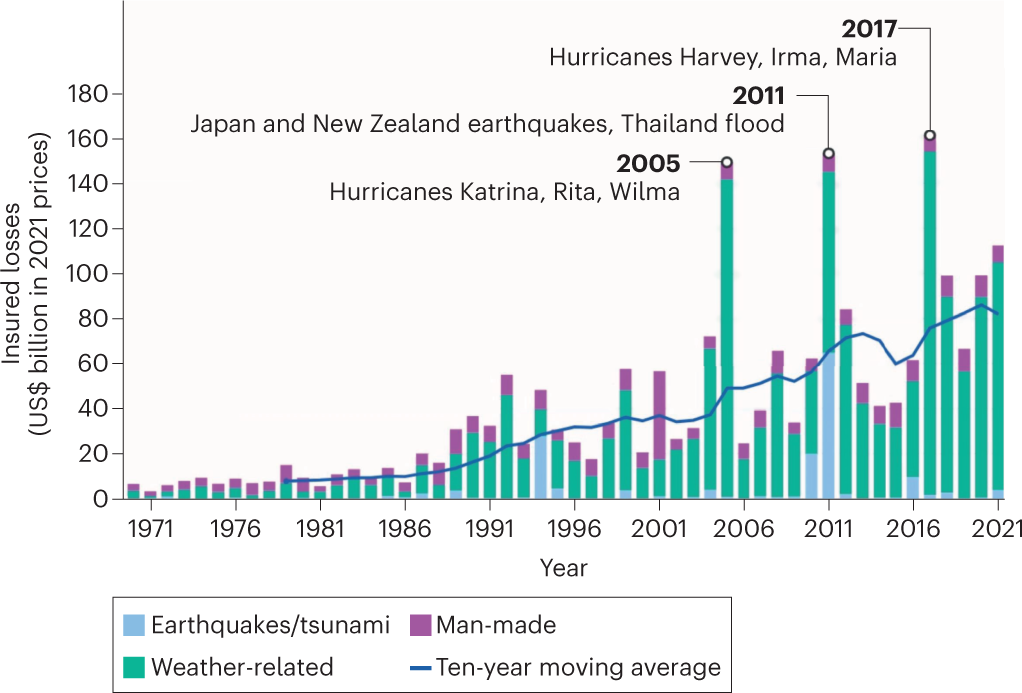

Climate alternate is stressful the frequencies and inflexibility of natural screw ups, consisting of hurricanes, cataracts, backfires, famines, and storms. These events affect in assets harm, commercial enterprise interruptions, and loss of lifestyles, leading to considerable coverage claims and payouts. According to the Insurance Information Institute, insured losses from natural screw ups were at the rise, reaching record conditions in recent times.

Conforming Risk Assessment and Financing

To acclimatize to the challenges of weather trade, insurers are incorporating climate threat assessment and modeling into their underwriting tactics. Advanced data analytics, remote seeing technologies, and climate modeling ways enable insurers to assess the implicit impact of climate change on specific regions, parcels, and portfolios.

Insurers are also conforming their underwriting criteria and pricing models to reflect the increased threat of climate- related events. This may involve revising content limits, deductibles, and decorations for parcels located in high- threat areas prone to flooding, backfires, or littoral storms.

Investing in Resilience and Mitigation

In addition to conforming threat assessment and underwriting practices, insurers are investing in adaptability and mitigation sweats to reduce the impact of climate change- related pitfalls. This includes promoting measures similar as

1. Flexible structure: Supporting investments in flexible structure, similar as flood tide walls, stormwater operation systems, and campfire- resistant structure accoutrements , to reduce the vulnerability of parcels to climate- related hazards.

2. Risk Reduction: Programs Offering threat reduction programs and impulses to policyholders, similar as abatements for enforcing energy-effective upgrades, installing rainfall- resistant roofing, or enforcing disaster preparedness plans.

3. Community Engagement: Uniting with governments, communities, and stakeholders to raise mindfulness about climate change pitfalls, promote sustainable land use practices, and develop comprehensive adaptability strategies at the original and indigenous situations.

Innovative Insurance Products

To address arising pitfalls associated with climate change, insurers are developing innovative insurance products and results acclimatized to specific climate- related pitfalls. These may include

1. Parametric Insurance: Parametric insurance products give content grounded on predefined triggers, similar as wind speed, downfall, or temperature thresholds, rather than traditional loss assessments. This enables briskly claims processing and payouts in the event of climate- related disasters.

2. Catastrophe Bonds: Catastrophe bonds, or” cat bonds,” are monetary units that switch disastrous danger from insurers to buyers. They deliver insurers with clean financial safety towards large- scale herbal failures, similar as hurricanes or earthquakes, by way of furnishing a source of backing for claims payouts

3. Index Insurance: Index insurance products give content grounded on predefined indicators, similar as crop yields, swash situations, or temperature diversions, rather than individual losses. This allows insurers to offer protection to vulnerable sectors, similar as husbandry, against climate- related pitfalls.

Conclusion

Climate change presents unknown challenges for the insurance assiduity, with the adding frequence and inflexibility of natural disasters driving up insurance claims and losses. Insurers are conforming to these new pitfalls by incorporating climate threat assessment into their underwriting processes, investing in adaptability and mitigation sweats, and developing innovative insurance products acclimatized to specific climate- related pitfalls.