Understanding the Basics

Insurance is a abecedarian element of ultramodern lifestyles, offering financial protection in opposition to unlooked-for activities. Whether it is securing your fitness, belongings, or enterprise, insurance performs a pivotal element in mollifying pitfalls and furnishing peace of mind. Still, for rookies, the world of insurance can feel daunting and complex. In this comprehensive companion, we’re going to break down the fundamentals of coverage, assisting you navigate through language, types of content material, and critical issues.

What is Insurance?

At its core, coverage is a agreement between an character( or business) and an insurance business enterprise. The individual pays a ornament — a designated quantum of plutocrat — frequently or as a one- time charge, in alternate for the insurer’s pledge to provide fiscal safety in opposition to specific pitfalls. These pitfalls could include accidents, ails, natural disasters, theft, or other unlooked-for events.

Key Terminology

Before delving deeper, it’s essential to understand some key terms associated with insurance:

1. Premium: The quantum of plutocrat an individual pays to the insurance company for content.

2. Policy: The written contract outlining the terms and conditions of the insurance agreement.

3. Coverage: The specific pitfalls or events for which the insurance company will give fiscal protection.

4. Deductible: The quantum the policyholder must pay out of fund before the insurance content kicks in.

5. Claim: A formal request made by the policyholder to the insurance company for compensation or content for a loss or damage.

Types of Insurance

Insurance comes in colorful forms, each designed to address different requirements and pitfalls. There are some normal types of insurance:

1. Health Insurance: Provides content for medical charges, including croaker visits, sanitarium stays, tradition specifics, and preventative care.

2. Life Insurance: Pays out a lump sum or everyday profits to heirs upon the policyholder’s death, furnishing fiscal protection to loved bones .

3. Auto Insurance: Protects against fiscal loss in case of accidents, theft, or harm to a car. It generally includes content for liability, collision, and comprehensive damages.

4. Homeowners Renters: Insurance Covers damage or loss to a home or its contents due to fire, theft, vandalization, or other covered events. Renters insurance specifically covers particular things for tenants.

5. Business Insurance: Shields businesses from fiscal losses performing from property damage, liability claims, or other pitfalls specific to the assiduity.

6. Travel Insurance: Offers content for trip cancellations, medical extremities, lost luggage, and other unlooked-for events while traveling.

Choosing the Right Coverage

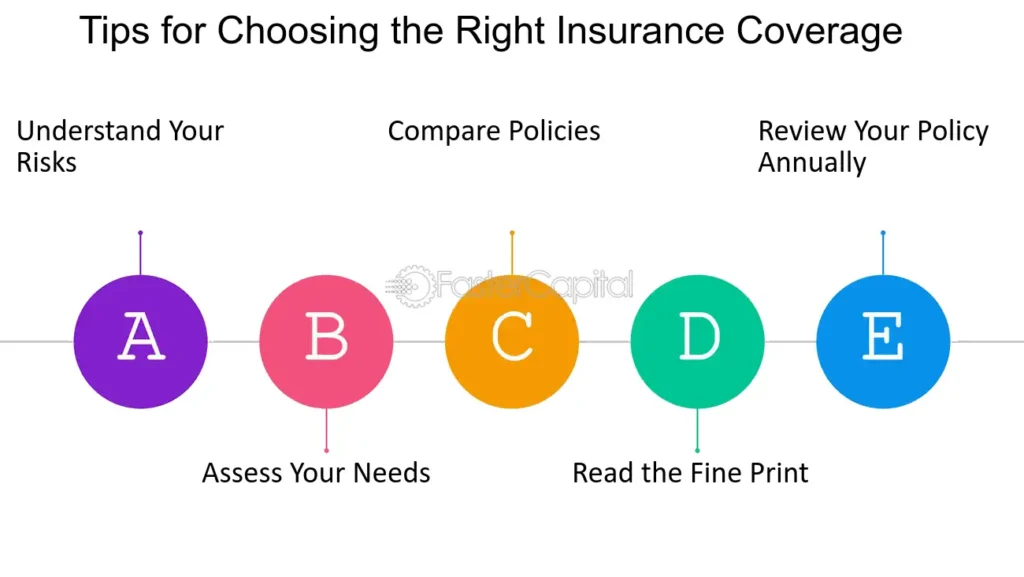

Opting the right insurance content requires careful consideration of your specific requirements, pitfalls, and budget. Then are some tips for newcomers

1. Assess Your pitfalls: Identify implicit pitfalls or events that could have significant fiscal consequences for you or your means.

2. Research Options: Compare insurance programs from different companies to find the content that stylish fits your requirements and budget.

3. Understand Policy Terms: Read the policy documents precisely, paying attention to content limits, rejections, deductibles, and other terms and conditions.

4. Seek Professional Advice: Consider consulting with an insurance agent or fiscal counsel who can give substantiated guidance grounded on your circumstances.

5. Review Regularly: Periodically review your insurance content to insure it remains acceptable and over- to- date with any changes in your life or means.

Conclusion

Insurance is a precious tool for guarding yourself, your loved bones , and your means against unanticipated events. By understanding the basics of insurance, familiarizing yourself with crucial language, exploring different types of content, and making informed opinions, you can insure that you have the right protection. Flash back, insurance isn’t just about peace of mind — it’s about securing your fiscal future.