Intro:

Insurance plays a critical part in securing means, mollifying pitfalls, and furnishing fiscal safety for individualities and companies. When integrated into a comprehensive fiscal plan, insurance serves as a pivotal element of wealth operation strategies. This composition explores the colorful ways insurance contributes to fiscal planning and wealth operation, from threat operation to wealth preservation and heritage planning.

Risk Management and Asset Protection

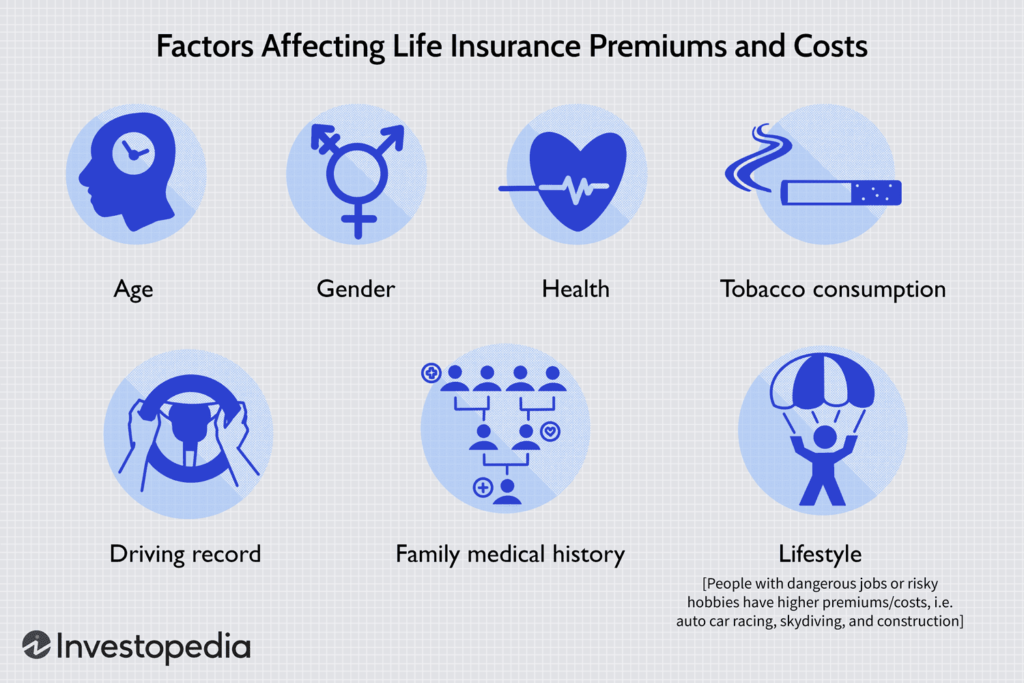

1. Life Insurance: Life insurance gives economic protection for loved bones inside the event of the policyholder’s loss of life. It can update misplaced profits, repay money owed, cowl burial costs, and insure the fiscal balance of heirs. For individualities with dependents or significant fiscal scores, life insurance is an essential threat operation tool.

2. Health Insurance: Health insurance covers medical charges and provides access to healthcare services, helping individualities manage the fiscal impact of illness or injury. By mollifying the threat of high medical bills and out- of- fund charges, health insurance preserves means and ensures individualities can go necessary medical care without depleting their savings.

3. Property and Casualty: Insurance Property and casualty insurance, which include homeowners insurance, renters coverage, and bus insurance, protects in opposition to belongings harm, theft, and legal responsibility pitfalls. By transferring those pitfalls to insurance companies, individualities can guard their method and cowl their fiscal properly- being in the face of unanticipated events comparable as accidents, herbal screw ups, or suits.

Wealth Preservation and Long-Term Planning

1. Income Protection: Disability insurance replaces a portion of misplaced income if the policyholder becomes unfit to work due to illness or injury. By furnishing fiscal support during ages of disability, this insurance ensures individualities can maintain their standard of living and save their wealth over the long term.

2. Long- Term Care Insurance: Long- term care insurance covers the cost of long- term care services, similar as nursing home care or in- home backing, for individualities who bear backing with conditioning of diurnal living due to age, illness, or disability. By planning for implicit long- term care requirements, individualities can cover their means and avoid the fiscal burden of long- term care charges.

3. Appropriations: appropriations are fiscal products that give a guaranteed sluice of income for a specified period or for life. They can serve as a tool for wealth preservation and withdrawal planning, offering a predictable source of income to supplement other withdrawal savings and investments.

Legacy Planning and Estate Protection

1. Estate Planning: Life insurance can play a crucial part in estate planning by furnishing liquidity to cover estate levies, debts, and executive charges. It allows individualities to pass on means to heirs at law and heirs without burdening them with fiscal scores or forcing the trade of estate means.

2. Business Succession Planning: For business possessors, life insurance can grease business race planning by furnishing finances to buy out a departed mate’s share of the business or to compensate for the loss of crucial labor force. It ensures the durability of the business and protects the fiscal interests of stakeholders.

3. Charitable Giving: Life insurance can be used as a tool for charitable paying, allowing individualities to leave a heritage by naming a charitable association as the devisee of a life insurance policy. It provides a duty-effective way to support charitable causes and leave a continuing impact on the community.

Conclusion

Incorporating insurance into a comprehensive fiscal plan is essential for managing pitfalls, conserving wealth, and achieving long- term fiscal pretensions. By using colorful types of insurance content, individualities and businesses can cover their means, secure their fiscal future, and produce a heritage that lasts for generations. From threat operation to wealth preservation and heritage planning, insurance plays a multifaceted part in fiscal planning and wealth operation strategies.