Intro:

As millennials continue to review colorful aspects of life, including work, connections, and finances, their approach to insurance is also evolving. This generation, generally defined as those born between 1981 and 1996, has distinct requirements and enterprises when it comes to insurance content. From digital natives to those prioritizing gests over material effects, millennials are reshaping the insurance geography. This composition delves into the unique requirements and enterprises of millennials regarding insurance and explores how the assiduity is conforming to meet their prospects.

Understanding Millennial Priorities

1. Digital Engagement: Millennials are digital natives, habituated to using technology for all aspects of life, including managing finances and copping insurance. They anticipate flawless digital gests and prefer insurance providers that offer stoner-friendly online platforms and mobile apps for policy operation and claims processing.

2. Financial Flexibility: With numerous millennials facing pupil loan debt, uncertain job requests, and rising living costs, fiscal inflexibility is pivotal. They seek insurance results that are affordable and customizable to fit their budgets and life choices.

3. Experience- acquainted Lifestyle: Millennials prioritize gests over material effects, frequently concluding for trip, entertainment, and heartiness conditioning. Insurance immolations that align with their life, similar as trip insurance, event cancellation content, and heartiness programs, are particularly appealing to this demographic.

Unique Insurance Needs of Millennials

1. Health Insurance: As millennials prioritize health and heartiness, they value comprehensive health insurance content that includes benefits similar as preventative care, internal health services, and telemedicine options. numerous millennials also prioritize access to indispensable healthcare options, similar as holistic drug and heartiness programs.

2. Renter’s Insurance: With homeownership getting less attainable for numerous millennials due to fiscal constraints and life preferences, renter’s insurance is essential for guarding particular things and liability content in rental parcels.

3. Gig Economy: Coverage With the rise of the gig frugality and freelance work, millennials frequently havenon-traditional employment arrangements that may not give traditional benefits like health insurance or disability content. Insurance results acclimatized to the gig frugality, similar as liability insurance for rideshare motorists or movable health insurance plans, are pivotal for fiscal security.

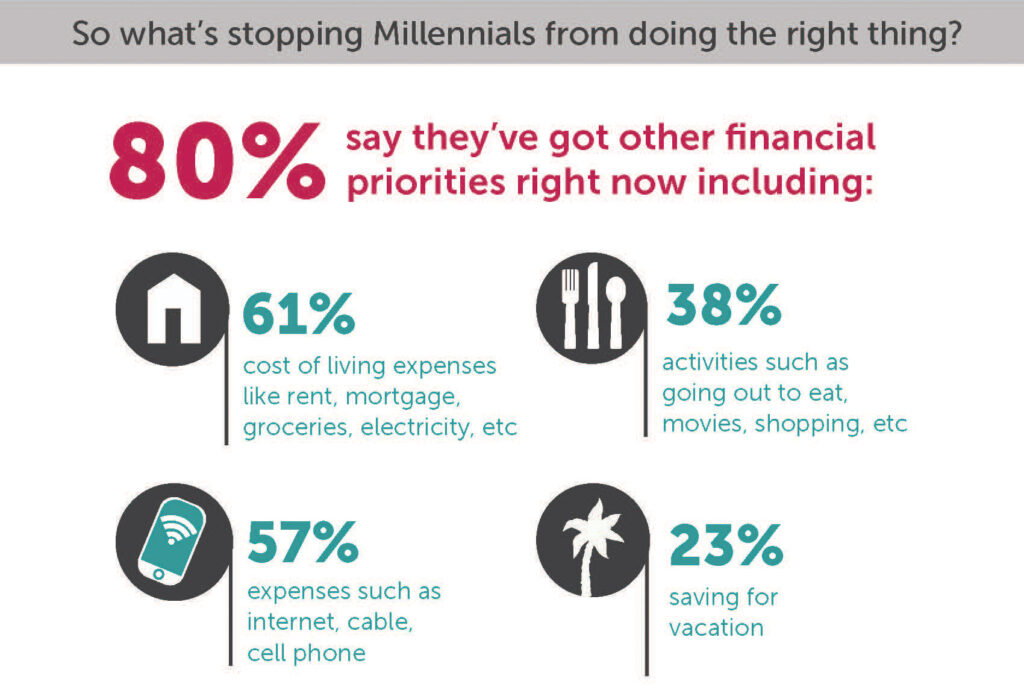

Concerns and Barriers to Insurance Coverage

1. Cost Despite: Feting the significance of insurance, cost remains a significant hedge for numerous millennials. Affordability is consummate, and they’re more likely to protect around for the stylish rates and abatements.

2. Complexity and Lack of translucency: Millennials value translucency and simplicity in insurance immolations. Complex policy language and retired freights can discourage them from copping insurance. They prefer straightforward explanations of content options and pricing.

3. Trust and Reputation: Millennials are skeptical of traditional institutions and seek out insurance providers with obvious commercial enterprise practices, high-quality client critiques, and a robust dedication to social duty and sustainability.

How the Insurance Industry is Responding

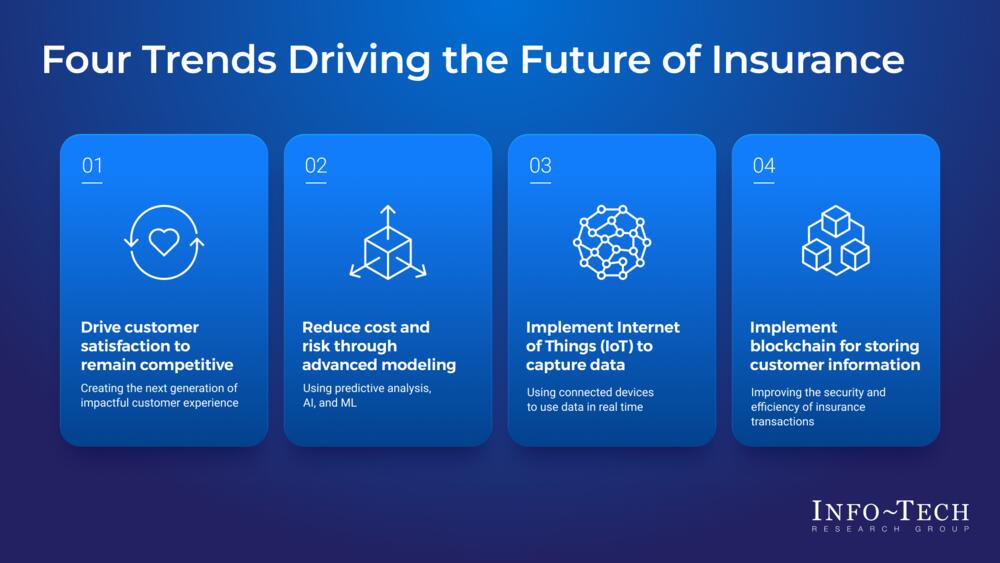

1. Digital Transformation: Insurance companies are investing in digital technologies to enhance the client experience, streamline policy operation, and offer substantiated insurance results acclimatized to millennial preferences.

2. Flexible Coverage Options: Feting the different requirements and cultures of millennials, insurance providers are offering more flexible content options, including operation- grounded insurance, pay- as- you- go programs, and customizable content packets.

3. Educational coffers: To address millennials’ enterprises about insurance complexity, numerous insurance companies are furnishing educational coffers, similar as online attendants, vids, and interactive tools, to help millennials understand their insurance options and make informed opinions.

Conclusion

As millennials continue to shape the insurance geography, insurers must acclimatize to meet their unique requirements and preferences. By understanding millennial precedences, offering acclimatized insurance results, and prioritizing translucency and simplicity, the insurance assiduity can effectively engage with this demographic and give the content and peace of mind they seek in an decreasingly uncertain world.