Introduction

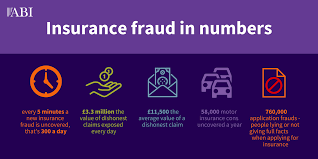

Insurance fraud is a pervasive hassle that charges insurers billions of bones each time and drives up decorations for policyholders. From inflated claims to falsified information, fraudsters employ colorful tactics to exploit insurance programs for fiscal gain. As a policyholder or business proprietor, it’s essential to be apprehensive of the pitfalls of insurance fraud and take visionary way to cover yourself and your business from falling victim to fraudulent conditioning.

Recognizing Insurance Fraud

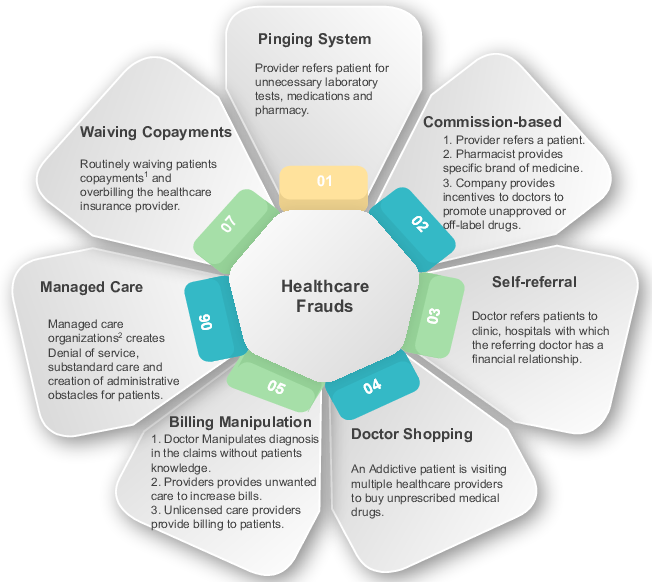

The first step in guarding yourself and your business from insurance fraud is to fete the signs of fraudulent exertion. Some common red flags include:

1. inflated Claims: Be cautious of individualities or businesses that file claims for damages that feel inordinate or inconsistent with the reported incident.

2. Multiple Claims: Pay attention to individualities or businesses with a history of filing frequent or recreating claims, especially for analogous types of losses.

3. Missing or Altered Information: Be suspicious of missing or altered attestation, similar as checks, bills, or medical records, which may indicate attempts to fabricate or inflate claims.

4. Reluctance to Cooperate: If a descendant is uncooperative or fugitive when furnishing information or attestation, it could be a sign of fraudulent exertion.

5. Changes in Lifestyle: unforeseen changes in a descendant ‘s life or geste , similar as extravagant purchases or unexplained wealth, may indicate fraudulent exertion.

By remaining watchful and feting the warning signs of insurance fraud, you can take visionary way to cover yourself and your business from implicit losses.

Preventing Insurance Fraud

Precluding insurance fraud requires a combination of alert, due industriousness, and visionary measures. Then are some strategies to help cover yourself and your business:

1. Corroborate Information: Always corroborate the delicacy and legality of information handed by heirs, including checks, bills, medical records, and substantiation statements. Follow up with third- party sources to confirm the details of the claim.

2. Maintain Attestation: Keep detailed records of all insurance deals, including programs, decorations, claims, and dispatches with insurers. Attestation can serve as substantiation in case of controversies or examinations.

3. Educate workers: Train workers and staff members to fete the signs of insurance fraud and report suspicious conditioning instantly. Encourage an open and transparent culture where workers feel comfortable raising enterprises about implicit fraud.

4. Apply Internal: Controls Establish robust internal controls and procedures to help fraud within your business, similar as separating duties, conducting regular checkups, and enforcing checks and balances in fiscal processes.

5. Work with Estimable: Insurers Choose estimable insurance companies with strong fiscal conditions and a track record of integrity and trustability. Research insurers completely before copping programs and consider seeking recommendations from trusted counsels or assiduity peers.

Reporting Suspected Fraud

Still, it’s essential to report it instantly to the applicable authorities, If you suspect insurance fraud. communicate your insurance company’s fraud hotline or claims department to report any suspicious conditioning or fraudulent claims. You can also report suspected fraud to original law enforcement agencies, state insurance departments, or technical fraud disquisition units.

Reporting fraud not only helps cover yourself and your business from fiscal losses but also contributes to the overall integrity of the insurance assiduity and helps combat fraudulent conditioning on a broader scale.

Conclusion

Insurance fraud poses a significant trouble to policyholders and businesses, leading to fiscal losses, increased decorations, and corrosion of trust in the insurance system. By feting the signs of insurance fraud, taking visionary preventative measures, and reporting suspected fraud instantly, you can cover yourself and your business from falling victim to fraudulent conditioning. Flash back that precluding insurance fraud is a collaborative trouble that requires cooperation between policyholders, insurers, and law enforcement agencies. By staying watchful and taking action against fraud, we can help insure the integrity and sustainability of the insurance assiduity for times to come.