Introduction

Life coverage is a vital monetary device that provides protection and protection for individualities and their loved bones. It offers a protection internet through furnishing economic guide within the occasion of the policyholder’s loss of life. Still, navigating the arena of existence coverage may be unmanning because of the numerous sorts of programs to be had and the complications involved. In this composition, we’ll claw into the fundamentals of life coverage, along with the exceptional styles of packages, their advantages, and important considerations that will help you make informed evaluations approximately your content.

Types of Life Insurance

Life insurance programs generally fall into two primary orders term life insurance and endless life insurance.

1. Term Life Insurance: Term life insurance provides content for a specified period, generally ranging from 10 to 30years.However, the death benefit is paid out to the heirs, If the insured individual passes down during the term of the policy. Term life insurance is known for its affordability and simplicity, making it an seductive option for individualities seeking temporary content to cover their loved bones during crucial life stages, similar as raising children or paying off a mortgage.

2. Permanent Life Insurance: Endless life insurance, as the name suggests, provides content for the insured’s entire continuance, as long as decorations are paid. Unlike term life insurance, endless programs also include a cash value element, which accumulates over time on a duty- remitted base. endless life insurance comes in colorful forms, including whole life, universal life, and variable life insurance, each offering different features and benefits suited to different fiscal pretensions and threat forbearance situations.

Benefits of Life Insurance

Life insurance offers several pivotal benefits that can give financial security and peace of mind to policyholders and their heirs at law:

1. Financial Protection: The number one benefit of lifestyles insurance is furnishing monetary safety to the policyholder’s heirs at regulation in the event in their dying. The demise advantage can help replace misplaced earnings, pay off debts, cover burial charges, and maintain the family’s trendy of residing.

2. Estate Planning: Life insurance can play a vital part in estate planning by furnishing liquidity to cover estate levies and other charges, icing that means can be transferred to heirs at law without the need to vend off precious means.

3. Tax Advantages: The death benefit paid out to heirs is generally duty-free, furnishing a duty-effective way to transfer wealth to the coming generation. also, the cash value accumulation in endless life insurance programs grows duty- remitted, allowing policyholders to make wealth over time.

4. Cash Value: Accumulation Permanent life insurance programs include a cash value element, which accumulates over time grounded on decorations paid and investment returns. Policyholders can pierce this cash value through policy loans or recessions for colorful purposes, similar as supplementing withdrawal income or covering unanticipated charges.

Considerations When Choosing Life Insurance

When opting a life insurance policy, it’s essential to consider several factors to insure that it aligns with your fiscal pretensions and needs:

1. Coverage Quantum: Determine the applicable content quantum grounded on your fiscal scores, including mortgage payments, outstanding debts, education charges, and unborn income needs for your dependents.

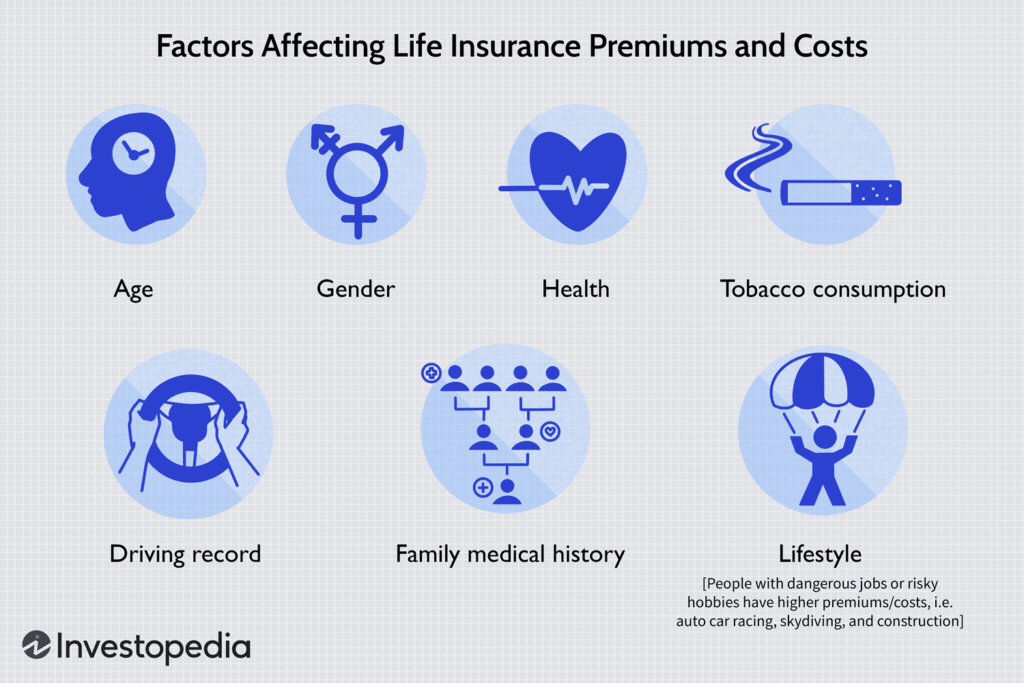

2. Decorations and Affordability: Estimate the cost of decorations and insure that they fit within your budget. Term life insurance generally offers lower decorations compared to endless life insurance, making it more affordable for numerous individualities.

3. Policy Duration: Consider how long you need content for and choose a policy duration that aligns with your fiscal pretensions and scores. Term life insurance may be suitable for temporary requirements, while endless life insurance provides lifelong content.

4. Policy Features: Understand the features and benefits of the policy, including any riders or fresh content options available. Consider factors similar as guaranteed death benefits, cash value accumulation, and inflexibility in decoration payments.

5. Financial Stability of the Insurer: Choose a estimable insurance company with a strong fiscal standing to insure that they can fulfill their scores and pay out claims when demanded.

Conclusion

Life insurance is a pivotal element of fiscal planning, furnishing protection and security for individualities and their families. By understanding the different types of life insurance programs, their benefits, and important considerations, you can make informed opinions about your content needs. Whether you conclude for term life insurance for temporary protection or endless life insurance for lifelong content and cash value accumulation, life insurance can offer peace of mind knowing that your loved bones will be taken care of financially in the event of your end.